Xero Health Check

You wouldn’t skip a regular car service - but when was the last time you looked under the hood of your cloud accounting file?

If it’s been a while, it might be time for a tune-up

Our Xero Health Check is designed to make sure you’re leveraging the full power of the cloud to work smarter, not harder.

Are you using Xero to its full potential? In our Xero health check, we review how you’re using the technology, while paying careful consideration to the people involved and your internal processes. We

believe that when all 3 areas (people, process, and technology) are truly aligned and humming, that is when you hit your operational efficiency sweet spot.

Our proven process

To ensure you are as efficient as possible in your use of Xero, we run through our proven process to challenge the status quo, and discuss, implement, and train you on improvements to ensure efficiencies are being used over time

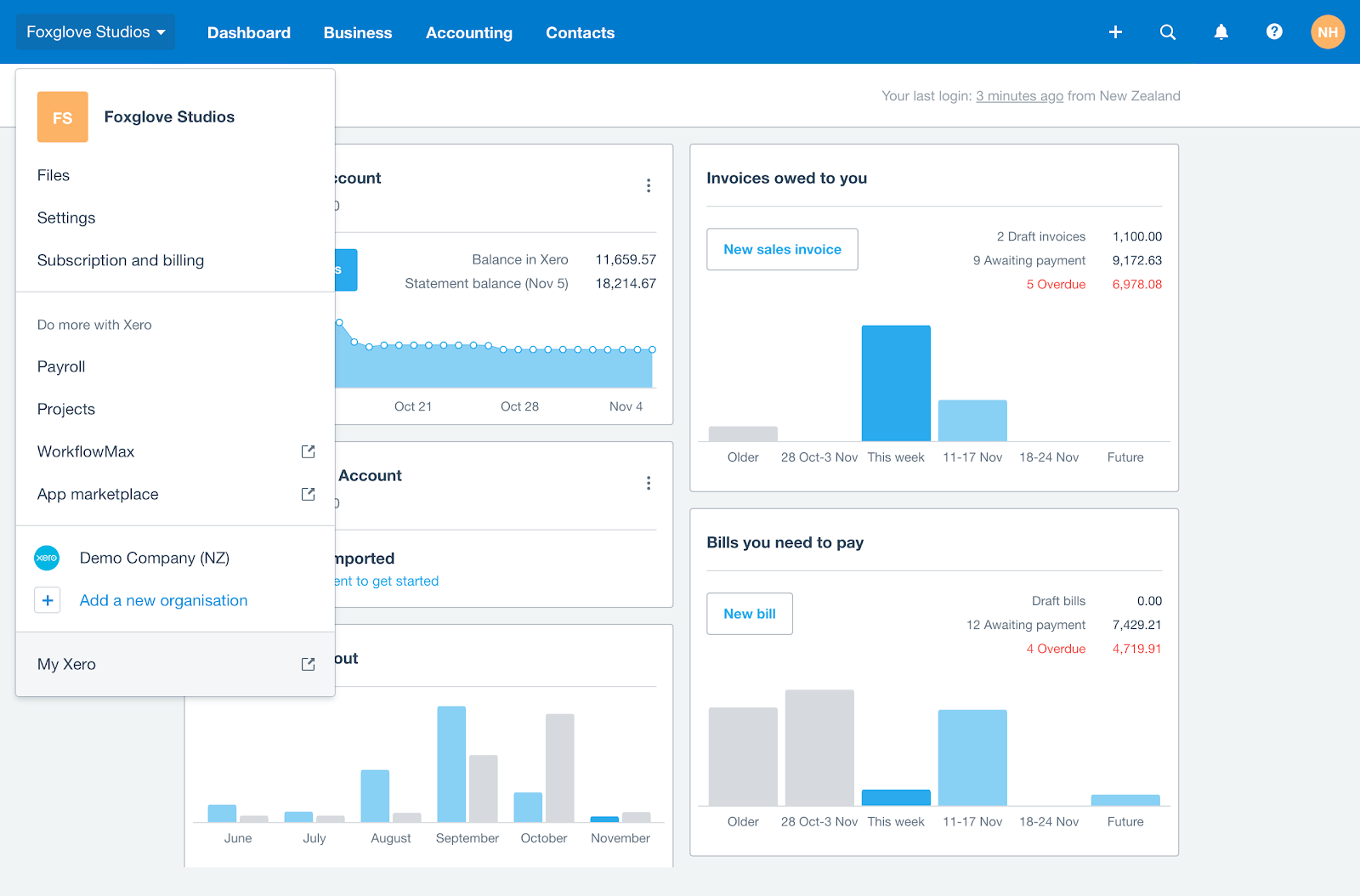

1 Xero File Review

We’ll start behind the scenes, reviewing how your record keeping and payroll systems are setup - ensuring appropriate accounts are being used, bank and credit card feeds have been established correctly, and reports, document capture, bill integration and direct connection to the Tax Office are all being used appropriately.

2 Findings & Training Session

Once we’ve conducted our File Review, we’ll meet to discuss the findings & recommendations. We’ll implement any recommended automations so that your general ledger file does the heavy lifting for you, and train you on any other items that will streamline your accounting processes. We’ll also help you set up any additional rules and memorisations, ensuring processes are as automated as possible.

3 Check-in - 1st month consolidation

One month in, we check-in to see how you are going with bedding down the general ledger file–

with further tweaks and training.

4 Check-in - First BAS

Prior to the lodgement of your first Business Activity Statement since conducting the original review, we’ll get together to take you through the process of how to generate, review and report directly to the tax office. While we’re at it, we’ll confirm that your newly implemented automations and streamlined processes are continuing to pay dividends in time savings.

We recently met with a client who was falling behind on their bookkeeping and a number of compliance tasks (bank reporting, ATO lodgements, plus others!).

Not only were they facing serious consequences from a regulatory perspective, but they were becoming increasingly overwhelmed with the bookkeeping task ahead of them.

We worked with the client and their external bookkeeper to conduct a broad review of their online cloud accounting system, Xero, and implemented a number of solutions to get over 300 transactions reconciled accurately, implementing automations and rules to eliminate the administrative burden moving forward.

“After an uptick in work and the hiring of a couple of new employees it was clear that this part of my business needed a tune up.

In stepped Steve from acumin.io with a plan to improve my management of both the accounting side and to help find strategies to use technology to improve the business. The combination of both those factors has been fantastic for my business.”

Darren Murphy

Verified Energy